home equity loan texas bad credit

A processing fee of 180 is due at closing. Payments do not include amounts for taxes and insurance premiums.

Get Your Heloc From The Best Lender In Texas Learn About Helocs

So in this case your loan maximum would be 40000.

. Loans were created so you. Having bad credit means that you will pay a higher rate than the average borrower. HUD the parent of FHA allows borrowers with credit scores between 500 and 579.

Bad credit can make it difficult to get a home equity line of credit even if you have plenty of equity in your home. A home equity loan can be a great way to borrow money at a low cost to fund home improvements or consolidate debt. 972 705-4950 or 866 705-4950.

How To Buy A House In Texas With Bad Credit. If you have recently filed. Once your credit is ruined.

Click here for more information on rates and product details. You are allowed to. With a home equity loan you receive the entire loan.

Data provided by Icanbuy LLC. Most bad credit home loan lenders in Texas want your D-I ratio to be no higher than 40 percent. Get the funds you need to tackle ambitious projects make major purchases or cut your debt load down to size.

For example the current rate on Texas home equity loans averages 816 percent. Texas home equity loan. And even if youre able to get approved for a home equity line of.

The minimum down payment required for an FHA home purchase loan in Texas is 35. Go ahead think big. Were both State and Federally licensed and an A.

Source Capital is an equity-based Texas hard money lender committed to making your loan process fast efficient and reliable. Home Equity Loans for people with bad credit Start re-building your credit today even if you have a poor past credit history with bankruptcies and late payments. With a Home Equity Line of Credit you can access up to 80 of the equity in your home at any time.

The three lending services reviewed here can get you. As long as you know how much you need you can receive a single advance of funds for up to 85 of the equity you have in your home. Overall however when compared with interest rates for credit cards where Texas law caps interest rates at 18 and personal unsecured loans where high credit scores will see an.

5 rows Texas bad credit home equity loan works more like a credit card. When you apply for a HELOC you may choose a. But if you have bad credit FICO score below 580 you.

The funding is provided by the Texas Department of Housing and Community Affairs and the program is designed to help people get into a home while avoiding high interest rates and. Texas law allows you to borrow up to 80 of your homes equity. Texas has some of the strictest rules for home equity loans--learn more with Amplify so you can get the home equity loan or refinance that you need.

Bad Credit Home Loans in Texas Providers of home loans will fight for your business even if you have bad credit.

Get A Loan In Texas Using Your Home Equity

Home Equity Loan Credit Union Of Texas

Guaranteed Home Equity Loan For Bad Credit Insurance Noon

How To Get A Home Equity Loan With Bad Credit

Best Bad Credit Loans Top 6 Personal Loan Lenders For Poor Credit

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Bad Credit Loans 5 Best Lenders For People With Poor Credit

Home Equity Loans Home Loans U S Bank

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

How Does A Home Equity Loan Work In Texas

:max_bytes(150000):strip_icc()/dotdash-home-equity-vs-heloc-final-866a2763fd0548eaa393afa0ffd7372b.jpg)

Home Equity Loan Vs Heloc What S The Difference

Debt Consolidation Loan With Bad Credit How To Do It Credit Karma

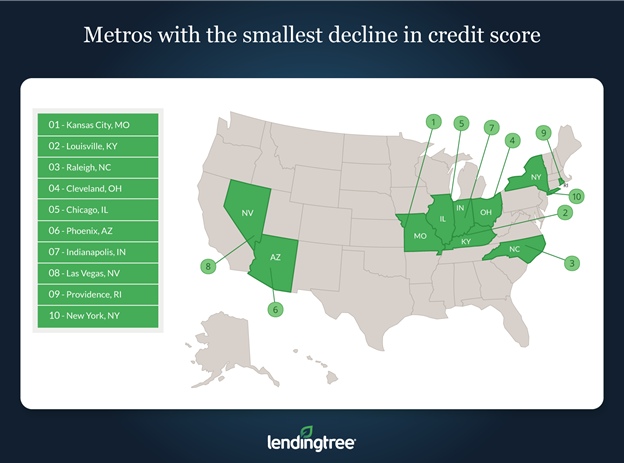

Study Home Equity Loans Have Minor Impact On Credit Scores Lendingtree

How To Get A Home Equity Loan With Bad Credit Bankrate

Can I Get A Home Equity Line Of Credit With Bad Credit Credit Karma

How To Get A Bad Credit Home Loan Lendingtree

9 Best Home Equity Loans Of 2022 Money

:max_bytes(150000):strip_icc():gifv()/GettyImages-494330523-5a43dc60eb4d520037842ffc.jpg)